Almost nothing could be more important to Americans than their economic stability when disabled or in their senior years. Social Security has long been called the “third rail” in American politics – to touch it is political suicide. We don’t think so. We think providing a system that ensures economic security for seniors is paramount. It is exactly what our government should be providing but isn’t.

important to Americans than their economic stability when disabled or in their senior years. Social Security has long been called the “third rail” in American politics – to touch it is political suicide. We don’t think so. We think providing a system that ensures economic security for seniors is paramount. It is exactly what our government should be providing but isn’t.

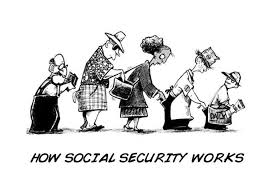

How does Social Security work today? Here is the answer in a nutshell: Social Security, or F.I.C.A., taxes are collected from today’s workers to pay today’s beneficiaries. If that sounds like a Ponzi Scheme it should, and you wouldn’t be the first to think so. Here is how much you pay in Social Security taxes and how.

The Federal Insurance Contributions Act (FICA) is the federal law that requires Employers to withhold three separate taxes from the wages they pay their employees and the additional taxes the employers must pay that are referred to as “matching” amounts. Your total FICA tax is comprised of:

Employee has to pay: (Withheld from wages by the employer)

- 6.2 percent Social Security tax;

- 1.45 percent Medicare tax (the “regular” Medicare tax);

- 0.9 percent Medicare surtax when the employee earns over $200,000.

Employers must withhold these amounts from an employee’s wages and deposit with Uncle Sam.

Employers additionally pay: (Matching amount)

- 6.2 percent Social Security tax;

- 1.45 percent Medicare tax (the “regular” Medicare tax).

That an employer pays a “matching amount” is an illusion and deception. It is an expense to the company as part of your total compensation, so you should consider it a further tax on your total income that you never see.

(The government also stops collecting FICA taxes on incomes above $118,500. Why?)

TOTAL AMOUNT OF YOUR COMPENSATION PAID TO F.I.C.A –

15.3%

Generally, we can begin collecting limited Social Security benefits at age 62, as long as our income is under $15,000/year. If we apply for S.S. benefits at age 67, we can earn as much as we want. But here is the rub: Our government continually works to increase the age for eligibility and to also limit benefit amounts and increases. After collecting 15.3% of our lifetime compensation, it is clear they would prefer that we all meet our maker as soon as possible lest they have to pay out too much in benefits.

How about some Real Social Security

Assume for a moment that you retire at 66 and collect a maximum benefit of $2,000/month. As of 2012, the average life expectancy in the U.S. is 79. That means you would collect about $312,000 in benefit payments. (156 months at $2000/month)

Now consider how much you would have if you invested in conservative broad based Mutual Funds over a lifetime of work earning a modest return of 6% per year. For example, let’s assume you have an income averaging $40,000 per year over 46 work years from age 20 to age 66.

(That is a monthly income of $3,333 x 15% = $500/month in S.S. contribution for 552 months.)

Your total actual contribution is $500 x 552 months = $276,000. With monthly compounded growth averaging 6% per year, your life’s work investment grows and grows. By how much?

TOTAL INVESTMENT VALUE AFTER 46 YEARS AT 6% – $1,484,347.44

Now that is REAL Social Security! Don’t believe me? Do the math yourself.

Instead, the U.S. government continues to collect FICA taxes using the revenue for general expenses and paying current beneficiaries. Opponents of personal, mandatory retirement investing use scare tactics claiming the stock market is too “risky”. However, the historic rate of return for the stock market during the 20th century was 10.4%. Yet our government’s debt has exploded exponentially and Social Security payouts are now unsustainable without tax and eligibility increases. The U.S. government’s debt is now over $19 trillion dollars, or $154,000 per household. (This does not include state and local government debt.) What our government is really afraid of is losing control of this huge revenue stream.

expenses and paying current beneficiaries. Opponents of personal, mandatory retirement investing use scare tactics claiming the stock market is too “risky”. However, the historic rate of return for the stock market during the 20th century was 10.4%. Yet our government’s debt has exploded exponentially and Social Security payouts are now unsustainable without tax and eligibility increases. The U.S. government’s debt is now over $19 trillion dollars, or $154,000 per household. (This does not include state and local government debt.) What our government is really afraid of is losing control of this huge revenue stream.

See also U.S. Debt Clock

In 1920, Charles Ponzi defrauded hundreds by selling an investment where older investors were paid returns using the new investor monies. This was considered a massive fraud and the name Ponzi Scheme has been used ever since. How else would you describe the funding of Social Security today.

The New American Party believes that mandatory, private investment in conservative, global, broad-base mutual funds, with strict government regulation would provide the best option for real Social Security. It would help our economy too. Eligible funds would include companies that operate under rules that limit executive compensation and bonuses, as well as administrative and brokerage fees to prevent abuse. The average rate of return speaks for itself.

In 2008, the real estate mortgage debacle introduced us all to the phrase “too big to fail”. It referred to businesses and they went to the U.S. Government for their bailout. But governments can fail too leading to crushing taxes and raging inflation. And who bails out the U.S. government with a $20+ trillion dollar debt and growing? It CAN happen here!

American citizens need a secure financial future. We think that requires a phasing-out of the old Social Security funding model and introduction of a new diversified, market based program. With a higher average return on investment we can contribute less and keep even more of our income in our pockets. The numbers don’t lie. Who do you trust to secure your economic future? We think it’s you!

Footnote: For those who would advocate defined Pension Plans, consider the Teamster’s / Central States Pension Cuts and City of Detroit pension cuts